Voicing a contrarian viewpoint of popular OSB provider DraftKings, Deutsche Bank analyst Carlo Santarelli yesterday pronounced the company’s momentum “somewhat stunted.” In an investor note, he stated that the company’s earnings were becoming more volatile.

Consequently, Santarelli lowered his financial estimates for DraftKings. However, he stuck with his price target of $35 per share and Hold rating. The stock was trading for $39.28 per share at the time.

Santarelli’s concerns included “regulatory risks increasing and another shortfall, relative to guidance” for the second quarter. He also felt year-over-year comparisons for the OSB industry would become more adverse in the latter half of 2024.

The analyst observed that the sports betting giant was losing market share, month by month, in the current quarter, even though its promotional discipline had improved. “Perhaps the two go hand in hand,” he speculated.

The company “is doing a better job slowing promotions, as promotions, when measured against handle and [gross gaming revenue], are reducing from a Y/Y perspective. We believe much of the reduction stems from recently launched states, specifically Ohio, while Maryland promotions are also down materially,” the analyst wrote.

Even so, he believed that signups of new players, traditionally costlier than reactivating existing customers, would eat into second-quarter margins, thanks to the recent OSB launch in North Carolina. But DraftKings’s promotional activity was described as “more tame,” down to 25.8 percent of handle in the second quarter from 29.5 percent a year earlier.

DraftKings’s guidance for second-quarter cash flow is $150 million. Santarelli reduced his own $175 million projection to $134 million. He also shaved dollars off his cash-flow projections for July through December to take into account Illinois’s July 1 tax increase, “which we believe likely erodes a healthy portion of the beat and raise buffer built into DKNG’s 2H24 guidance.”

Santarelli foresaw $30 million in “leakage” from the higher Illinois levy (40 percent for DraftKings) in the last half of this year. While “mitigating efforts” were underway to curb a $60-million-per-year headwind, the analyst opined, “We don’t anticipate much easing in the 2H24, given much of the advertising has already been contracted.”

In light of the growth trajectory he saw in 2025 and beyond, Santarelli deemed DraftKings’s valuation (18 times cash flow) reasonable. He added that “incremental questions” would be forthcoming and that a projected return on investment of $2.1 billion was become more dubious over the next year to 18 months.

One of the reasons for Santarelli’s pessimism was DraftKings’s hold-percentage projections. The OSB provider had predicted 10.5 percent hold for the year, which would require exceeding that percentage in March through December. (First-quarter hold was 9.8 percent.)

Blaming baseball outcomes and an upset at the U.S. Open golf tournament, Santarelli predicted that second-quarter hold would fall short of 10.5 percent. This would require that DraftKings reach 11 percent the remainder of the year.

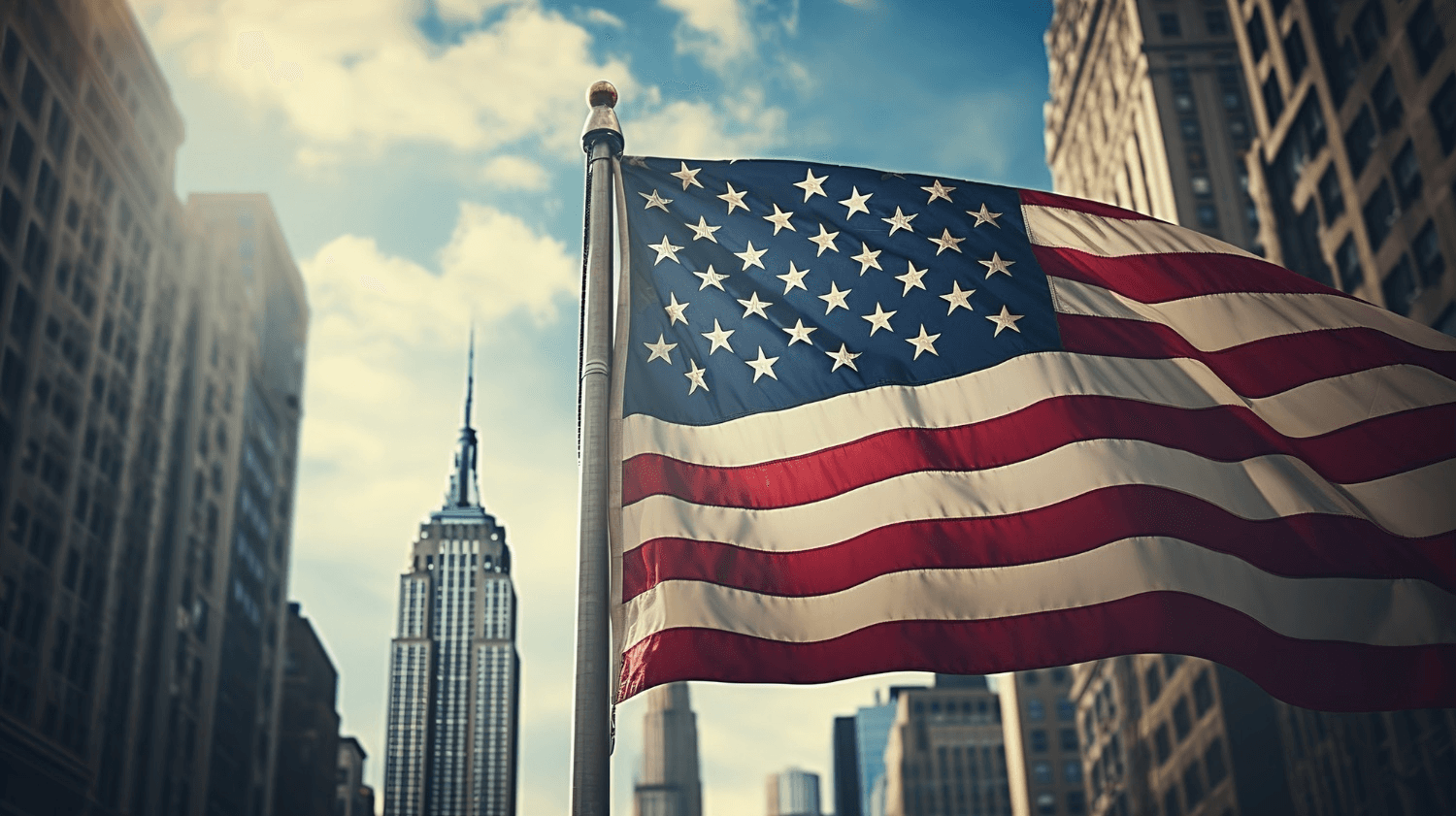

Looking at the U.S. OSB market as a whole, Santarelli said that one might conclude that it is “healthy and trending up.” He added that this was misleading, as a dramatic increase in betting in New York state was pulling the rest of the country higher with it. When the Empire State was backed out, DraftKings’s market share was down.

Please fill out the form to send a message to the CDC Gaming Reports team. Alternatively, you can send an email to the address on the footer of each page.

2024-06-26

2024-06-26